Sole

Proprietorship Bookkeeping

-

How Sole Proprietorships Work?

-

Key Bookkeeping Tasks

-

A Simple Example

Sole Proprietorship Bookkeeping

“Sole proprietorship bookkeeping involves tracking income, expenses, and owner withdrawals while keeping personal and business finances clearly separated.”

Let’s break down what this means and how to manage it properly.

1. How Sole Proprietorships Work

In a sole proprietorship, the business and the owner are legally considered the same entity. This means the owner receives all the profits from the business but is also personally responsible for any business debts. There’s no separate tax return for the business; instead, all income and expenses are reported on the owner’s personal tax return. Because of this close connection, bookkeeping for a sole proprietorship focuses heavily on keeping clean, organized records while maintaining a clear boundary between personal and business finances.

2. Key Bookkeeping Tasks for Sole Proprietors

3. A Simple Example

Key

Takeaways

✅ Keep business and personal finances separate—even if you're the only one running it

✅ Track income, expenses, and owner withdrawals accurately

✅ Use owner’s draw—not salary—for personal withdrawals

✅ Good bookkeeping makes tax filing easier and avoids financial confusion

Access all Accounting and Bookkeeping Courses from One Portal.

Mastering Bookkeeping and Accounting

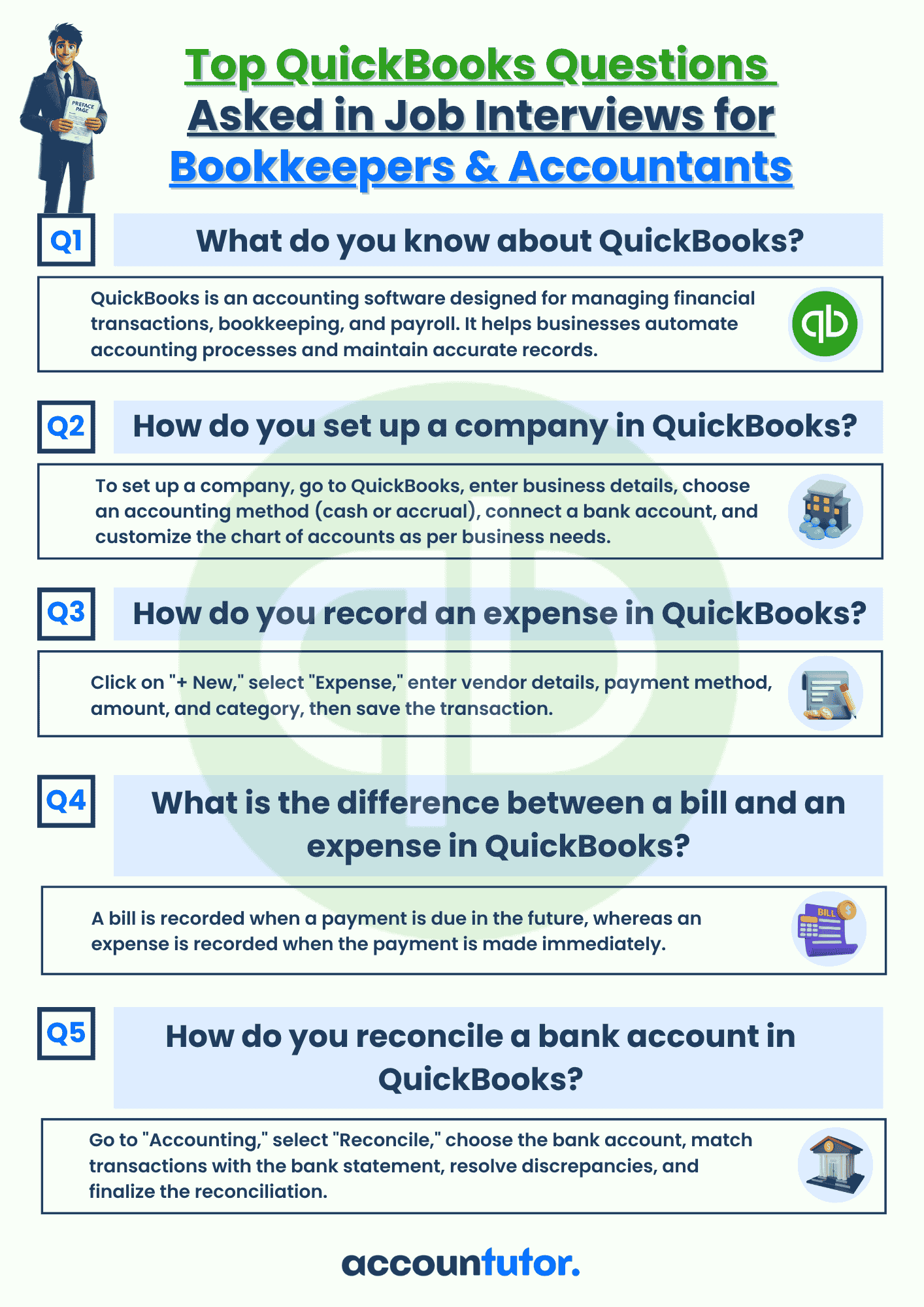

QuickBooks Online For Bookkeepers

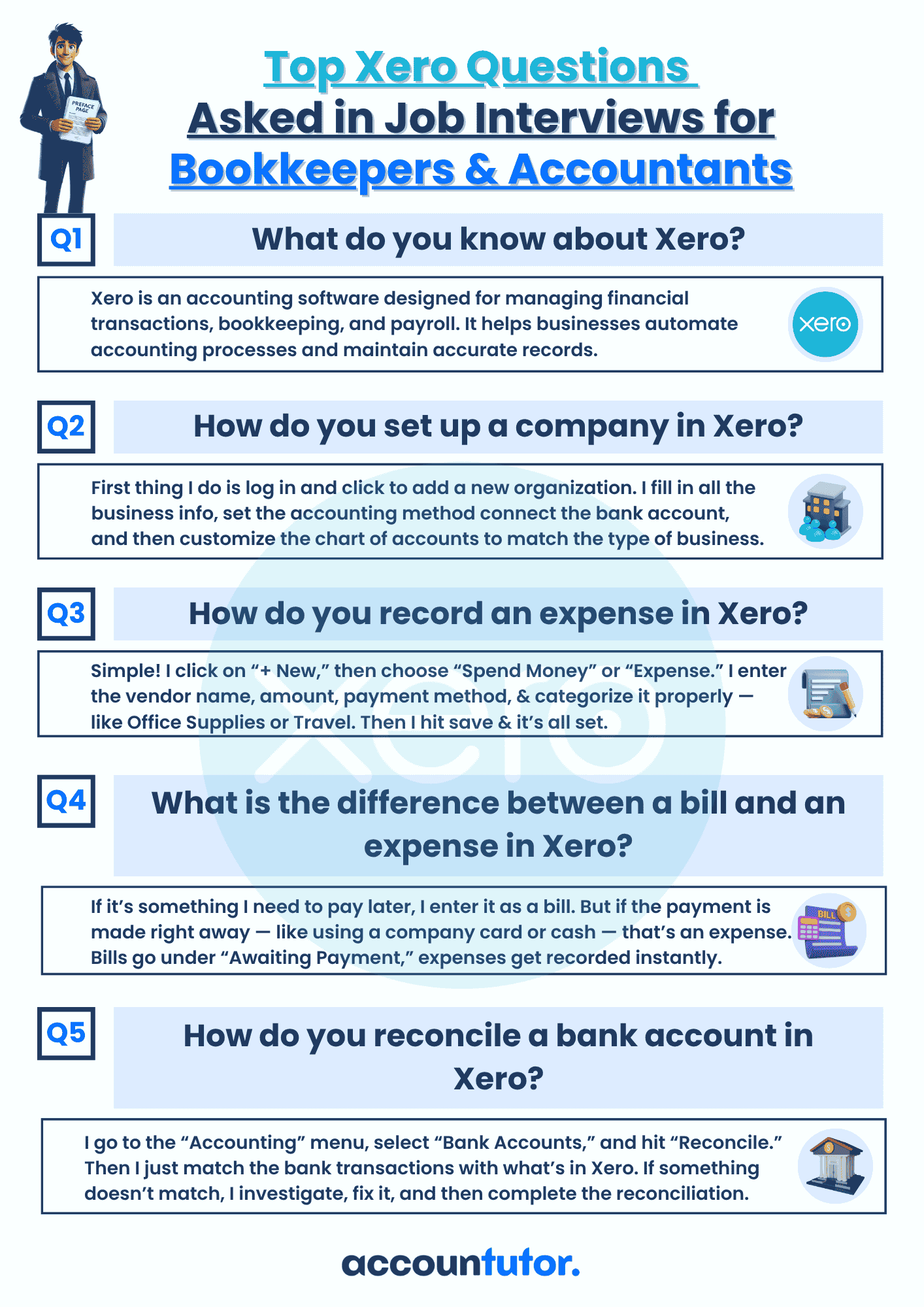

Xero Accounting For Bookkeepers

ChatGpt for Bookkeepers and Accountants

Subscribe to our newsletter

Policy Pages

Register for this webinar: How to Master QuickBooks Online— Without Feeling Overwhelmed