Importance

of Internal Controls

-

Why Internal Controls Matter

-

Types of Internal Controls

-

Benefits for Small Businesses

Identifying and Correcting Errors

Internal controls are the rules, procedures, and practices a business puts in

place to protect its resources, ensure accurate records, and prevent mistakes

or fraud.

“Think of internal controls as a security system for your business’s money and information.”

They’re not just for big companies—every business needs them, no matter the size.

“Think of internal controls as a security system for your business’s money and information.”

They’re not just for big companies—every business needs them, no matter the size.

1. Why Internal Controls Matter

Internal controls play a crucial role in helping businesses operate safely and efficiently. They help protect cash and assets from loss or theft, catch errors early before they turn into bigger issues, and keep records accurate for reliable reporting and tax filing. Strong internal controls also help build trust with customers, employees, and investors by showing that the business is managed responsibly. For example, requiring two people to approve large payments can prevent one person from making a dishonest transaction. Similarly, performing a weekly cash count ensures that the cash in the register matches the sales recorded—helping spot discrepancies before they become serious problems.

2. Types of Internal Controls

There

are different types of internal controls depending on what needs to be

protected within the business. Physical controls include

things like locks, safes, or limiting access to valuable inventory to prevent

theft or misuse. Authorization controls require approval before certain

actions—such as making payments—can be completed, helping prevent unauthorized transactions.

Reconciliation involves

regularly comparing records, such as matching bank statements with accounting

books, to catch errors or missing entries. Another important control is the separation of duties, which

ensures that no single person is responsible for an entire financial process,

reducing the risk of fraud or mistakes. These various systems work together to

create strong layers of protection and improve accuracy in financial

management.

3. Correcting the Errors

Even in a small business, having

simple internal controls can make a big difference. Practices like using

accounting software with login restrictions, reviewing financial reports on a

weekly basis, and safely storing receipts are all effective ways to keep things

organized and secure. These controls help you spot errors quickly, prevent

dishonest behavior, and make smarter financial decisions. They also

ensure you're better prepared for audits or tax season, giving you

confidence and peace of mind in your business operations.

Key Takeaways

✅ Internal controls help prevent errors, fraud, and losses

✅ They keep your records accurate and build business trust

✅ Physical, approval, and reconciliation controls are common types

✅ Even small businesses should have basic controls in place

✅ Good controls = better decisions, fewer surprises, and peace of mind

✅ They keep your records accurate and build business trust

✅ Physical, approval, and reconciliation controls are common types

✅ Even small businesses should have basic controls in place

✅ Good controls = better decisions, fewer surprises, and peace of mind

Write your awesome label here.

Access all Accounting and Bookkeeping Courses from One Portal.

Mastering Bookkeeping and Accounting

MBA simplifies accounting, ledger management, account balancing and financial statement preparation.

QuickBooks Online For Bookkeepers

From Beginner to Expert: Master QuickBooks Online. Effortlessly Navigate, Analyze Transactions, and Unlock its Full Potential.

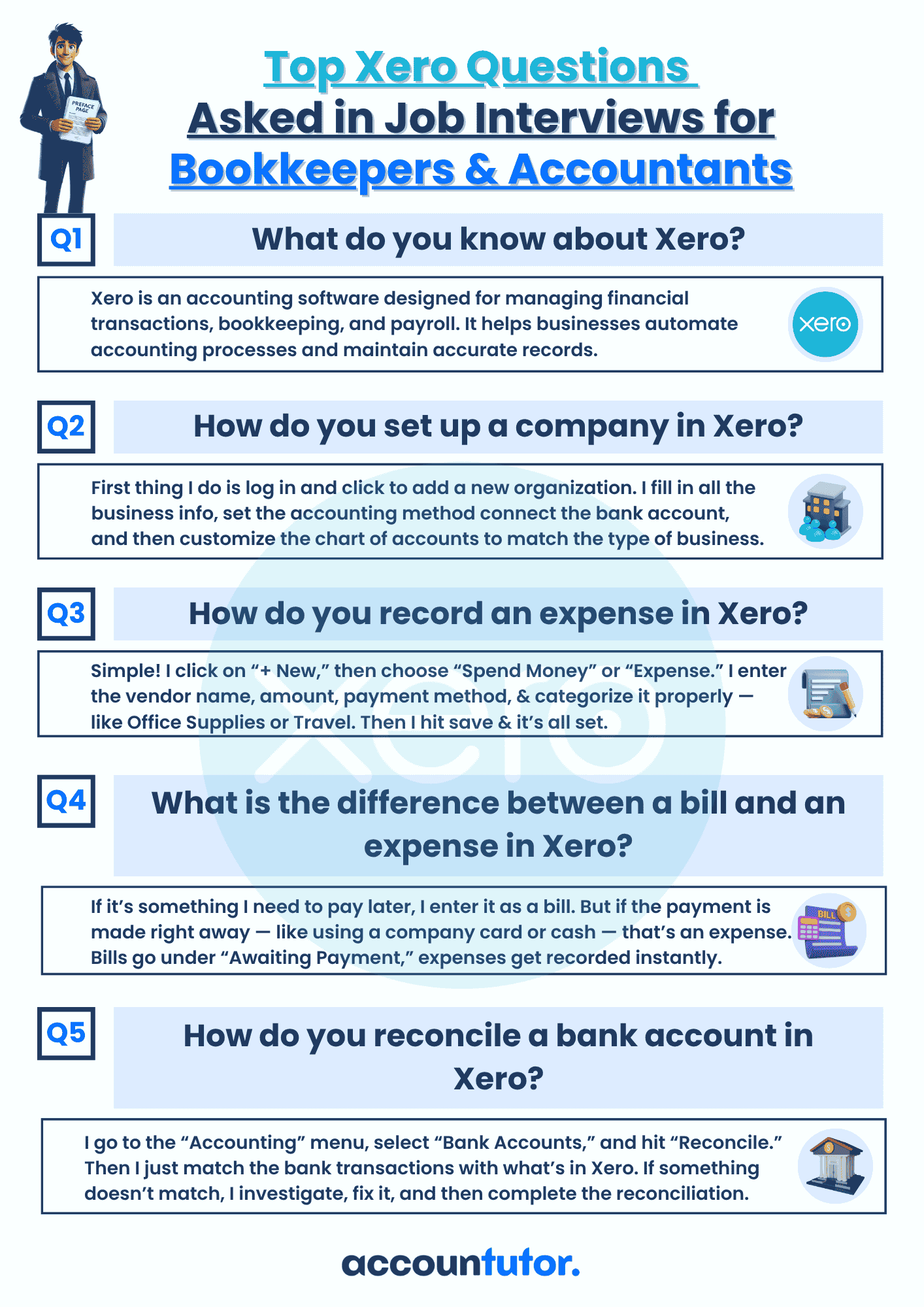

Xero Accounting For Bookkeepers

Learn how to use Xero, the leading online accounting software to perform most of the essential bookkeeping tasks.

ChatGpt for Bookkeepers and Accountants

Learn how to use the ChatGPT prompt toolkit to simplify daily accounting tasks for accountants and bookkeepers instantly.

Subscribe to our newsletter

Stay informed with the latest accounting tips, tools, and updates from Accountutor right in your email inbox.

Thank you!

Policy Pages

Download QuickBooks Online PDF Guide

Thank you!

Download QuickBooks Online Cheat Sheet

Thank you!

Download ABCD of Accounting

Thank you!

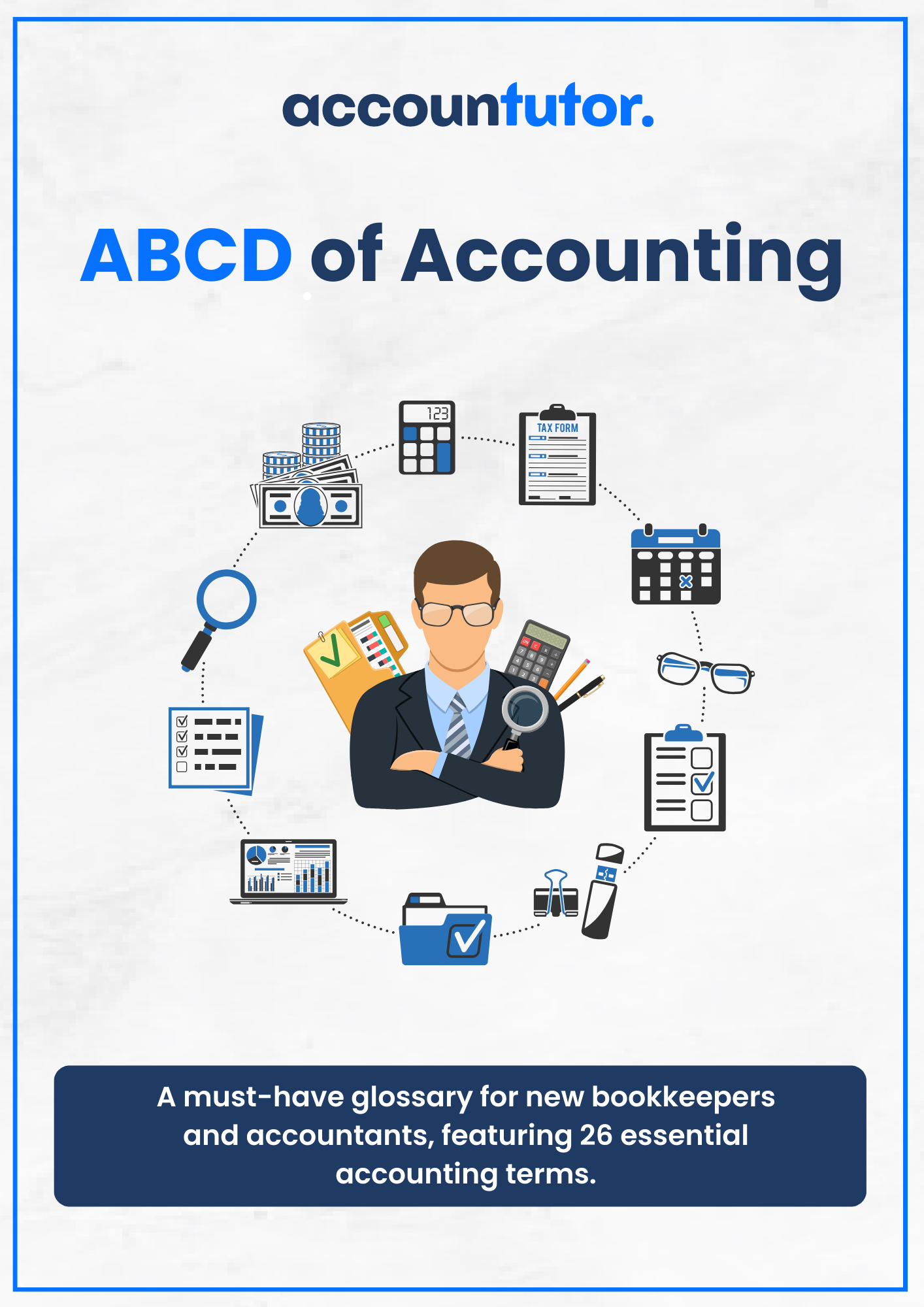

Download Checklist 2024

Thank you!

Register For Free!

Thank you!

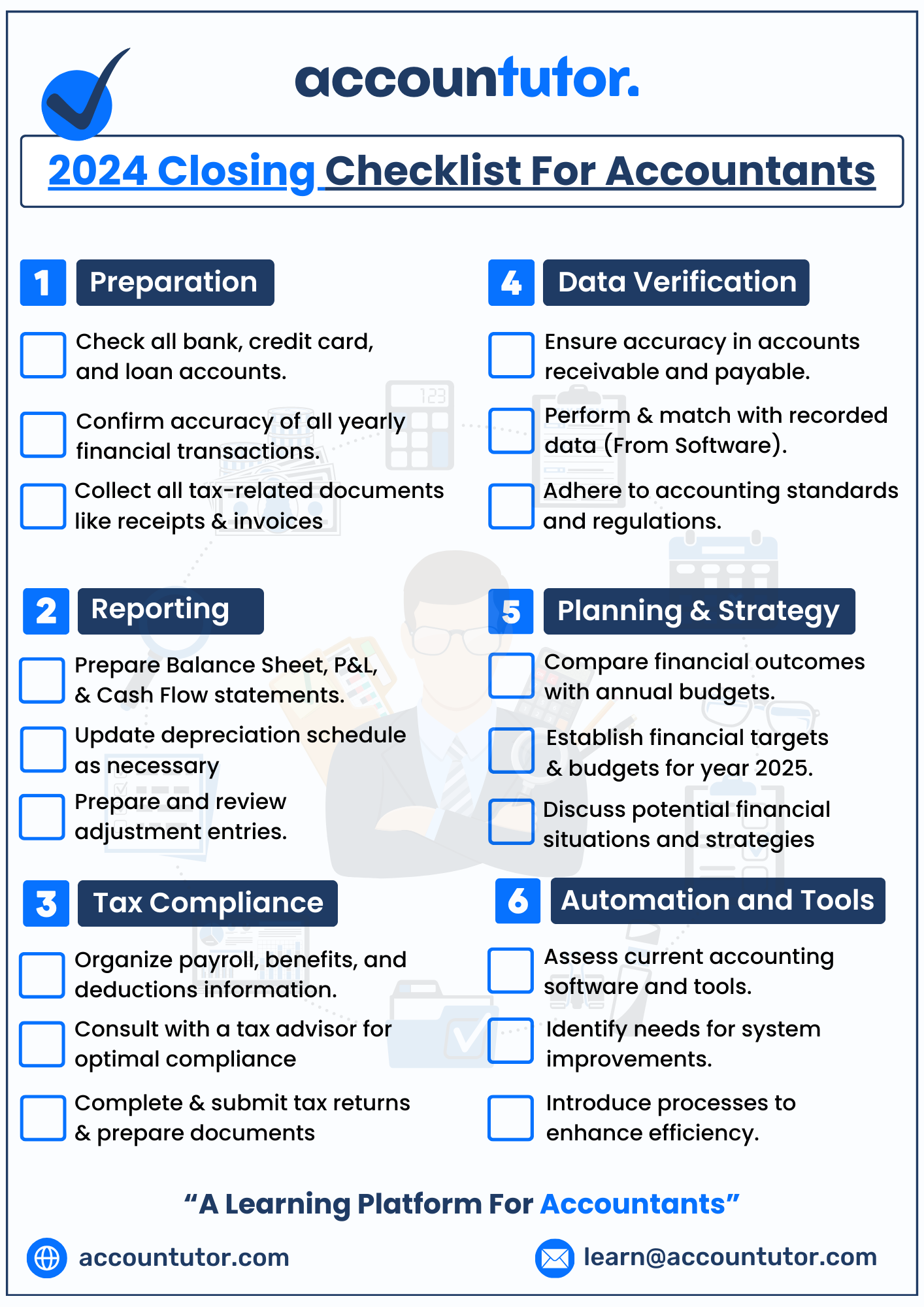

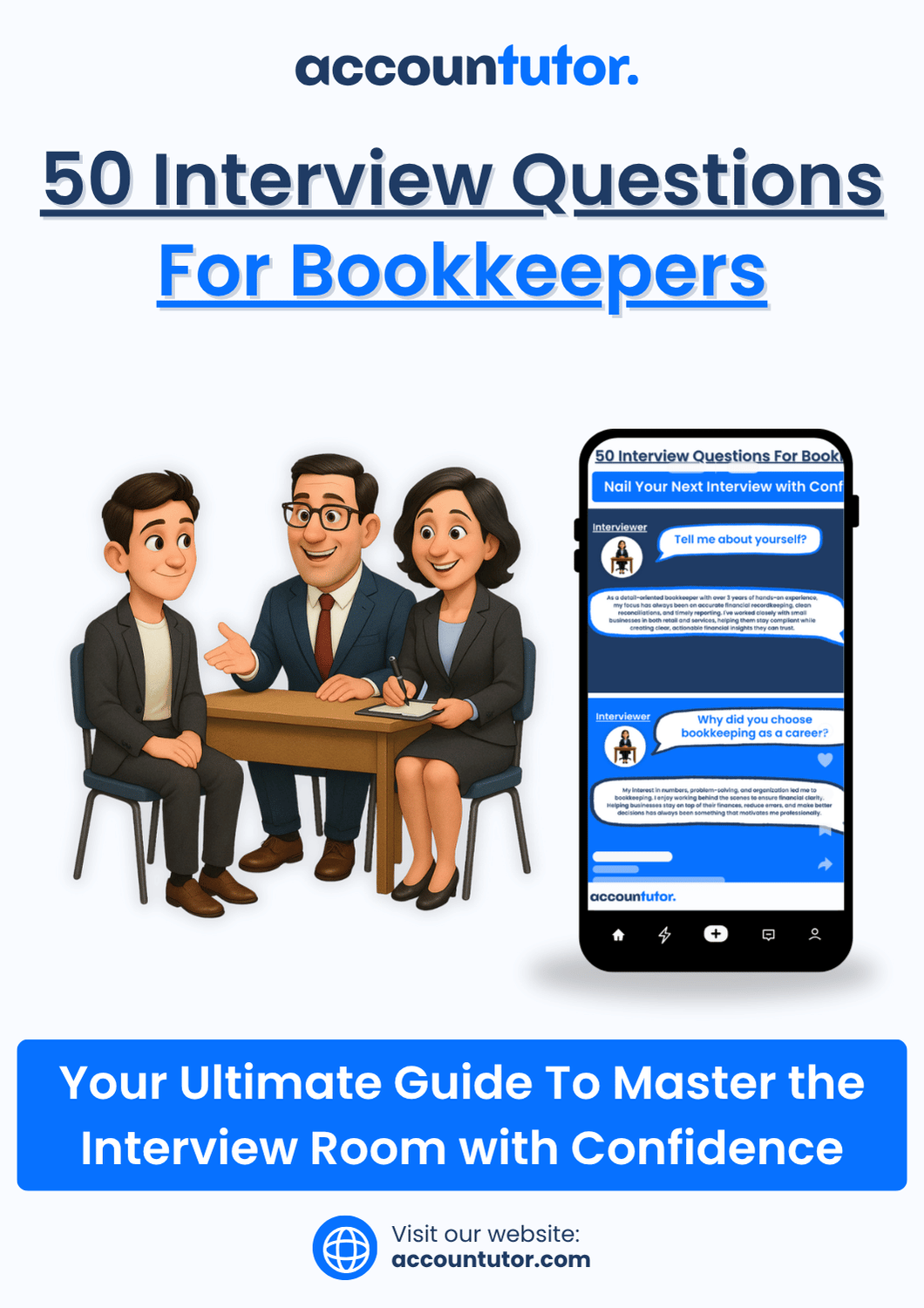

Download Interview Questions

Thank you!

Register for this webinar: How to Master QuickBooks Online— Without Feeling Overwhelmed

7th JUNE 2025 | 8:00 AM PST | 11:00 AM EST

Thank you! The joining link will be sent to your email shortly!

Webinar joining link will be sent to your email address.

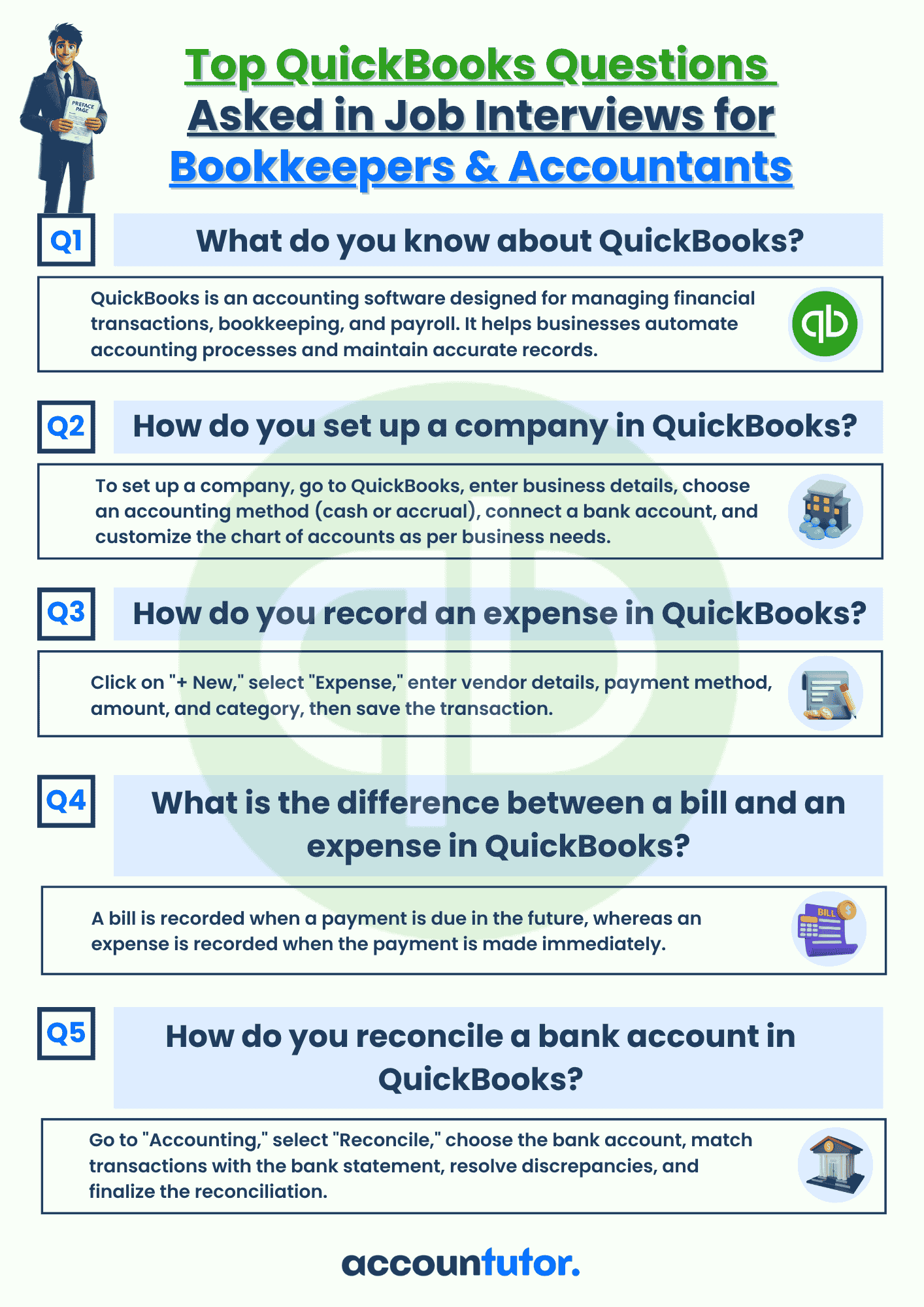

Download QBO Job Interview Questions and Answers PDF

Thank you!

Download Interview Questions

Thank you!

Download 50 Interview Questions For Bookkeepers

Thank you!

Download QuickBooks Online Guidebook

Thank you!