Accounting

vs Bookkeeping

-

Recording and Interpreting

-

Bookkeeping is step 1 & Accounting is step 2

-

Work with transactions and reports

-

Requires accuracy and analysis

-

Tools and Skills also vary

What is Accounting and Bookkeeping?

Bookkeeping

and accounting are often confused, and people use the terms interchangeably.

But they are not the same thing. According to Investopedia:

“Bookkeeping is the recording of financial

transactions, whereas accounting is the interpreting, classifying, analyzing,

reporting, and summarizing of financial data.”

That might sound a bit technical, so let’s break it down into plain language—with examples!

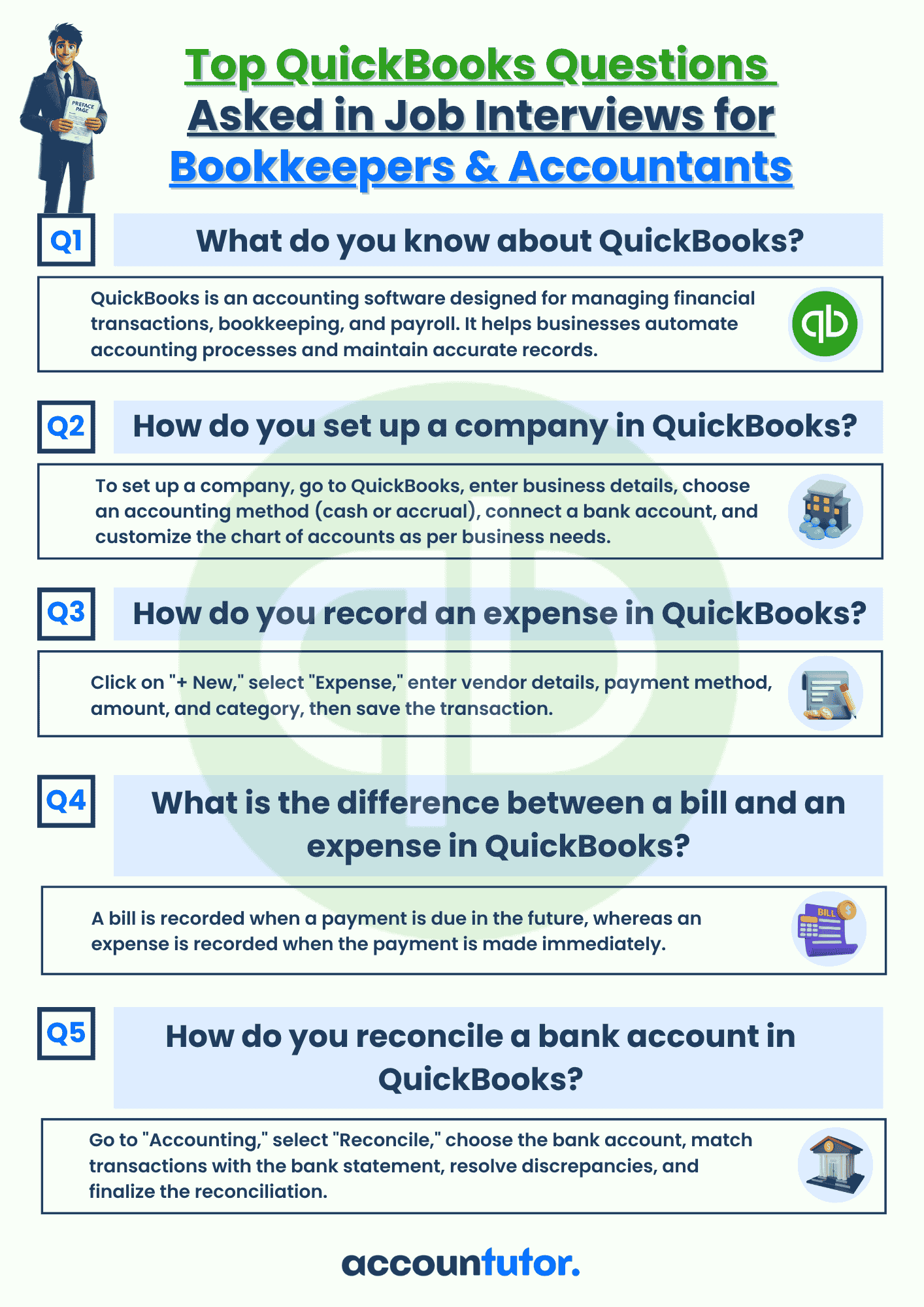

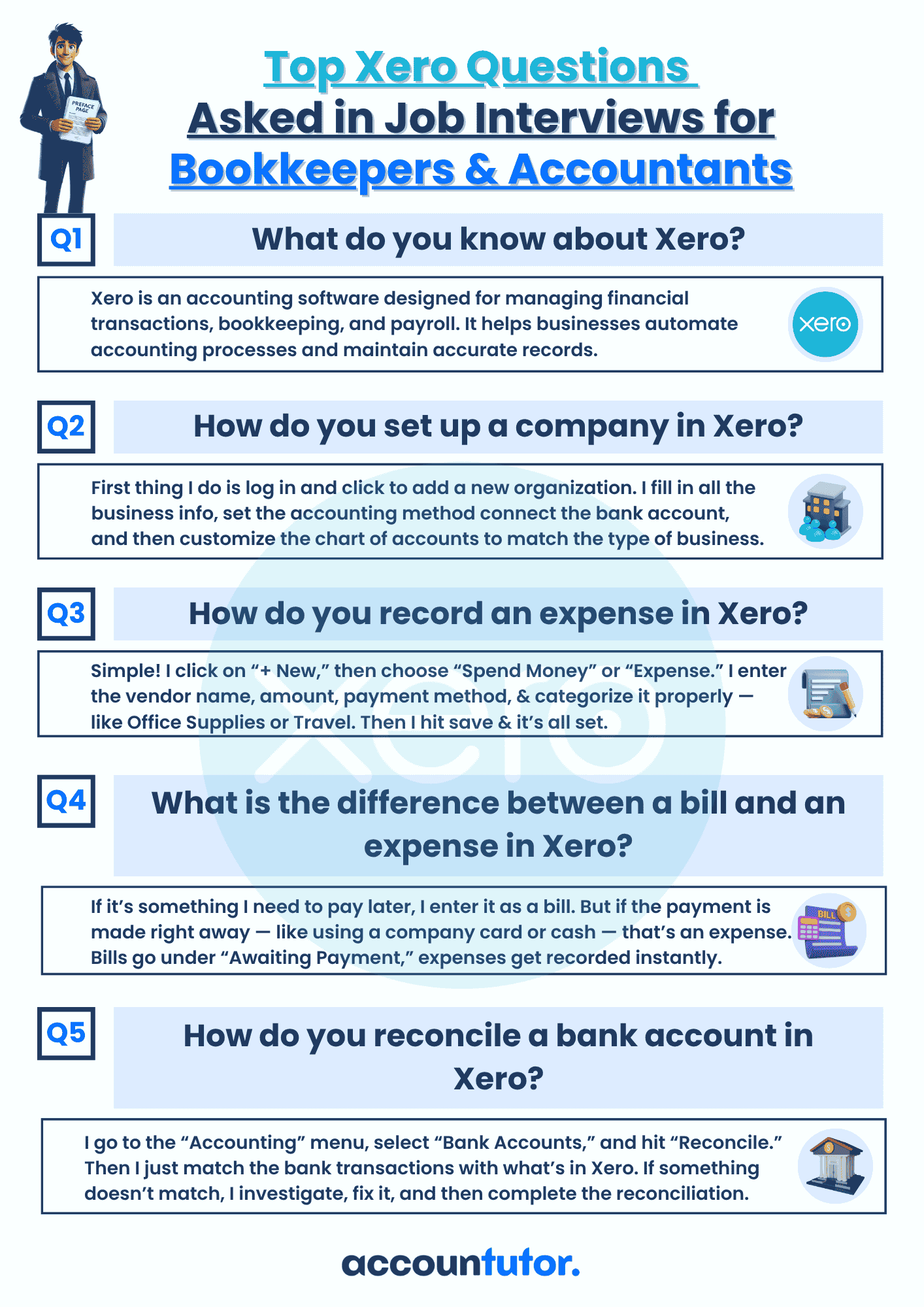

1. Bookkeeping is About Recording, Accounting is About Interpreting

2. Bookkeeping is Step 1, Accounting is Step 2

Bookkeeping comes first. Without accurate and up-to-date records, accounting has nothing to work with. In that sense, bookkeeping lays the foundation, and accounting builds on it. Think of it like cooking—bookkeeping is where you write down every ingredient you used in a recipe, while accounting is where you figure out how much the meal cost to make and how much profit you earned from selling it. One keeps track of the details, and the other helps you understand the bigger picture.

3. Bookkeepers Work With Transactions, Accountants Work With Reports

Bookkeepers handle the daily nuts and bolts of financial activity. They deal with things like recording sales and purchases, tracking receipts and payments, updating bank entries, and managing invoices and bills. Accountants, on the other hand, focus on the bigger picture. They prepare financial statements like the Profit & Loss report, file tax returns, create budgets and forecasts, and help shape business strategy. Both roles are essential to the success of a business, but their responsibilities are quite different.

4.

Bookkeeping Requires Accuracy, Accounting Requires Analysis

Bookkeeping is all about getting every entry right—dates, amounts, and categories. It involves a lot of detailed work and consistency to ensure that every transaction is recorded accurately. Accounting, on the other hand, is about stepping back and looking at the big picture. It answers questions like: Is the business growing? Are the costs too high? Is there enough cash to invest? While bookkeepers are focused on the fine details, accountants are focused on making informed decisions based on those details.

5. Tools and Skills Also Vary

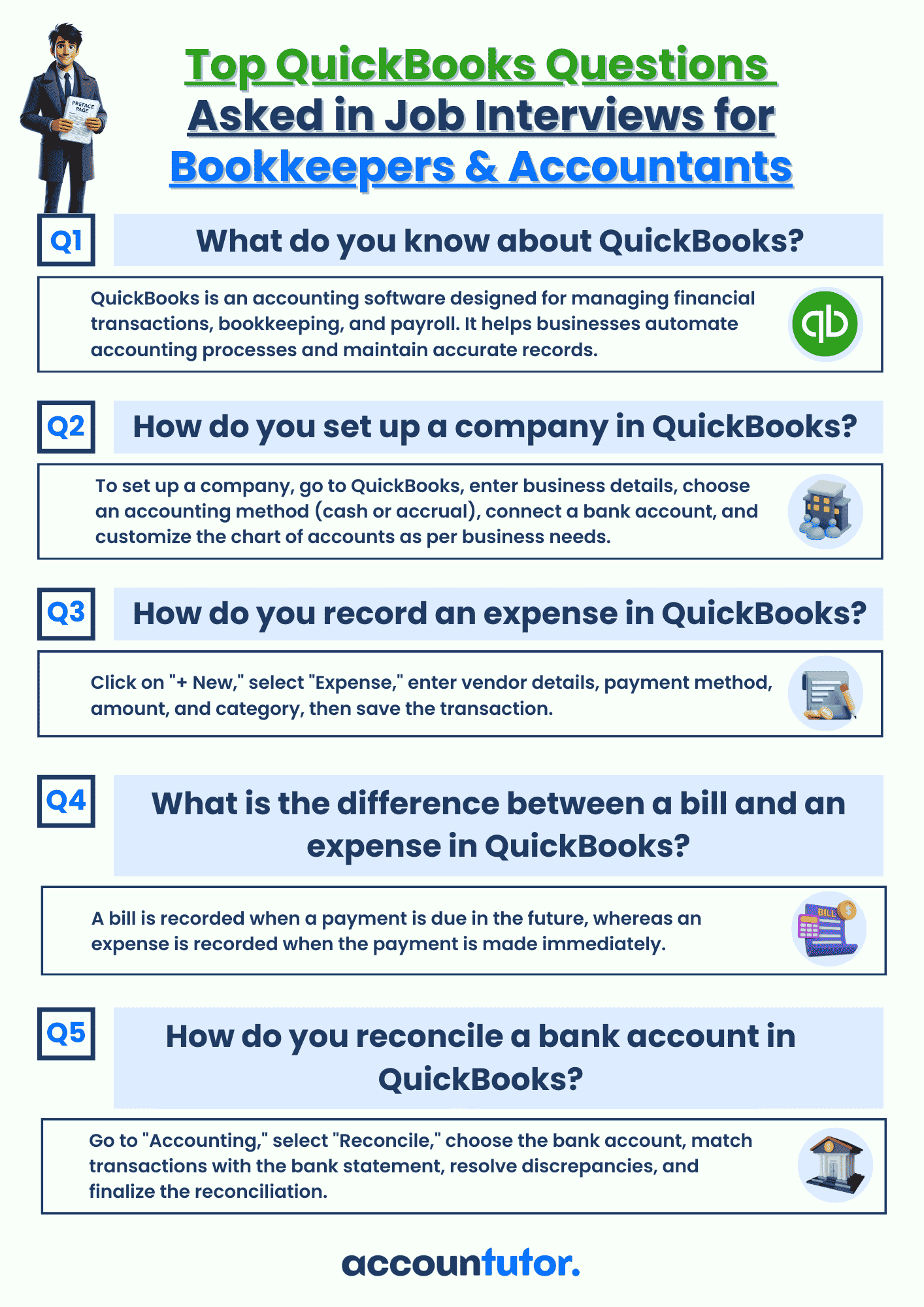

While both bookkeepers and accountants may use tools like QuickBooks or Excel, their focus areas are quite different. Accountants often work with more advanced tasks such as financial modeling, tax planning, auditing software, and staying updated with compliance regulations. Bookkeepers, on the other hand, concentrate more on data entry, bank reconciliations, and tracking daily transactions. Because bookkeeping provides a strong foundation in financial records, many people begin their careers as bookkeepers and later grow into accountants—it’s a natural and logical progression.

Key Takeaways

✅ Accounting is the process of analyzing and interpreting those transactions.

✅ Bookkeeping comes first; accounting comes next.

✅ Bookkeepers focus on details; accountants focus on decisions.

✅ Both are essential to running a successful business.

Access all Accounting and Bookkeeping Courses from One Portal.

Mastering Bookkeeping and Accounting

QuickBooks Online For Bookkeepers

Xero Accounting For Bookkeepers

ChatGpt for Bookkeepers and Accountants

Subscribe to our newsletter

Policy Pages

Register for this webinar: How to Master QuickBooks Online— Without Feeling Overwhelmed