How does Accounting really works?

What is Accounting?

Accounting is far more than just tracking numbers or balancing books—it’s

the foundation of sound financial management. At its core, accounting involves

the systematic process of recording, summarizing, and interpreting financial data.

This data is then used to make informed decisions, evaluate performance, and

plan for the future.

Think of accounting as the universal language of business. It translates complex financial activities into a format that can be understood by business owners, investors, and other stakeholders. Whether you’re running a small bakery or managing a multinational corporation, accounting serves as the compass that keeps you on the path to financial stability.

Why Is Accounting Important?

1. Provides Financial Clarity

Accounting organizes financial data into clear and actionable insights. With well-maintained records, businesses can understand their financial position, evaluate profitability, and identify areas for improvement.

2. Supports Decision-Making

Should you invest in new equipment? Hire more employees? Expand to a new location? Accounting provides the data needed to make these decisions with confidence.

3. Ensures Compliance

Accurate accounting ensures that businesses meet regulatory requirements, such as tax filings, financial reporting standards, and audits.

4. Facilitates Growth

The Accounting Process: A Step-by-Step Guide

Accounting involves a series of steps that ensure every financial transaction is accurately recorded, categorized, and reported. Let’s explore this process in detail:

1. Transactions: The Starting Point

Every financial activity begins with a transaction. A transaction is any event that impacts a business financially, such as:

- Selling a product or service: A bakery sells pastries for $500.

- Paying a bill: The bakery pays $200 for electricity.

- Taking out a loan: The bakery borrows $5,000 to purchase new equipment

These transactions form the raw data that feeds into the accounting system.

2. Recording Transactions: Journal Entries

Transactions are recorded in a journal using journal entries, which ensure that every event is documented accurately. This step is the foundation of double-entry accounting—a system where every transaction affects at least two accounts.

Example of a Double-Entry System:

The bakery buys $1,000 worth of flour and sugar in cash.

- Debit: Expenses account (flour and sugar increase the bakery’s costs).

- Credit: Cash account (cash

decreases as it is spent).

This system ensures the accounting equation remains balanced:

Assets = Liabilities + Equity

3. Posting to the Ledger

Once recorded, transactions are posted to the general ledger. The ledger groups similar transactions into accounts, such as:

- Revenue: Tracks income from sales or services.

- Expenses: Records costs like rent, utilities, and supplies.

- Assets: Lists what the business owns, such as equipment and inventory.

- Liabilities: Tracks what the business owes, such as loans or unpaid bills.

The ledger acts as the database of financial activity, helping businesses organize data for analysis and reporting.

4. Summarizing Data: Financial

Statements

The final step of the accounting process is summarizing the data into

financial statements. These statements provide a comprehensive view of a

business’s financial health and performance.- Balance Sheet: Shows a snapshot of the business’s assets, liabilities, and equity at a specific point in time.

- Profit and Loss Statement (P&L): Summarizes revenue and expenses over a period, revealing whether the business made a profit or loss.

- Cash Flow Statement: Tracks the inflows and outflows of cash, highlighting the business’s liquidity.

The Power of Accounting: Interpreting Financial Data

• Identify Trends: Rising expenses, declining revenue, or increasing debts can signal areas for action.

Example of Interpretation: A bakery notices that utility expenses have increased by 20% over three months. With this insight, the owner investigates energy-saving measures or renegotiates utility contracts to reduce costs.

A Real-World Example: Accounting in Action

Scenario: You own a small bakery.

1. Recording Transactions:

- At the start of the month, you purchase $1,000 worth of ingredients (recorded as an expense).

- Throughout the month, you sell pastries and cakes, earning $5,000 (recorded as revenue).

Your ledger shows:

- Revenue Account: $5,000 from sales.

- Expense Account: $1,000 for ingredients.

Your ledger shows:

- Revenue Account: $5,000 from sales.

- Expense Account: $1,000 for ingredients.

By interpreting these results, you can assess profitability and plan for future growth, such as investing in new equipment or hiring additional staff.

Why Understanding Accounting Matters

1. Ensures Financial Accuracy

Accurate accounting minimizes errors and ensures that financial statements reflect the true performance of the business.

2. Maintains Balance

The double-entry system keeps the books balanced, ensuring that assets always equal liabilities plus equity.

3. Guides Decision-Making

With reliable financial data, businesses can make informed decisions about investments, expenses, and growth opportunities.

4. Builds Credibility

Accurate financial records enhance trust among stakeholders, including investors, lenders, and regulators.

Common Accounting Challenges

- Misclassifying Transactions: Categorizing expenses as assets or vice versa can distort financial reports.

- Neglecting Reconciliations: Failing to reconcile accounts can lead to inaccuracies.

- Overlooking Adjustments: Adjustments for accrued expenses or revenue are essential for accurate reporting.

Practical Tips for Better Accounting

- Stay Organized: Keep detailed records of every transaction.

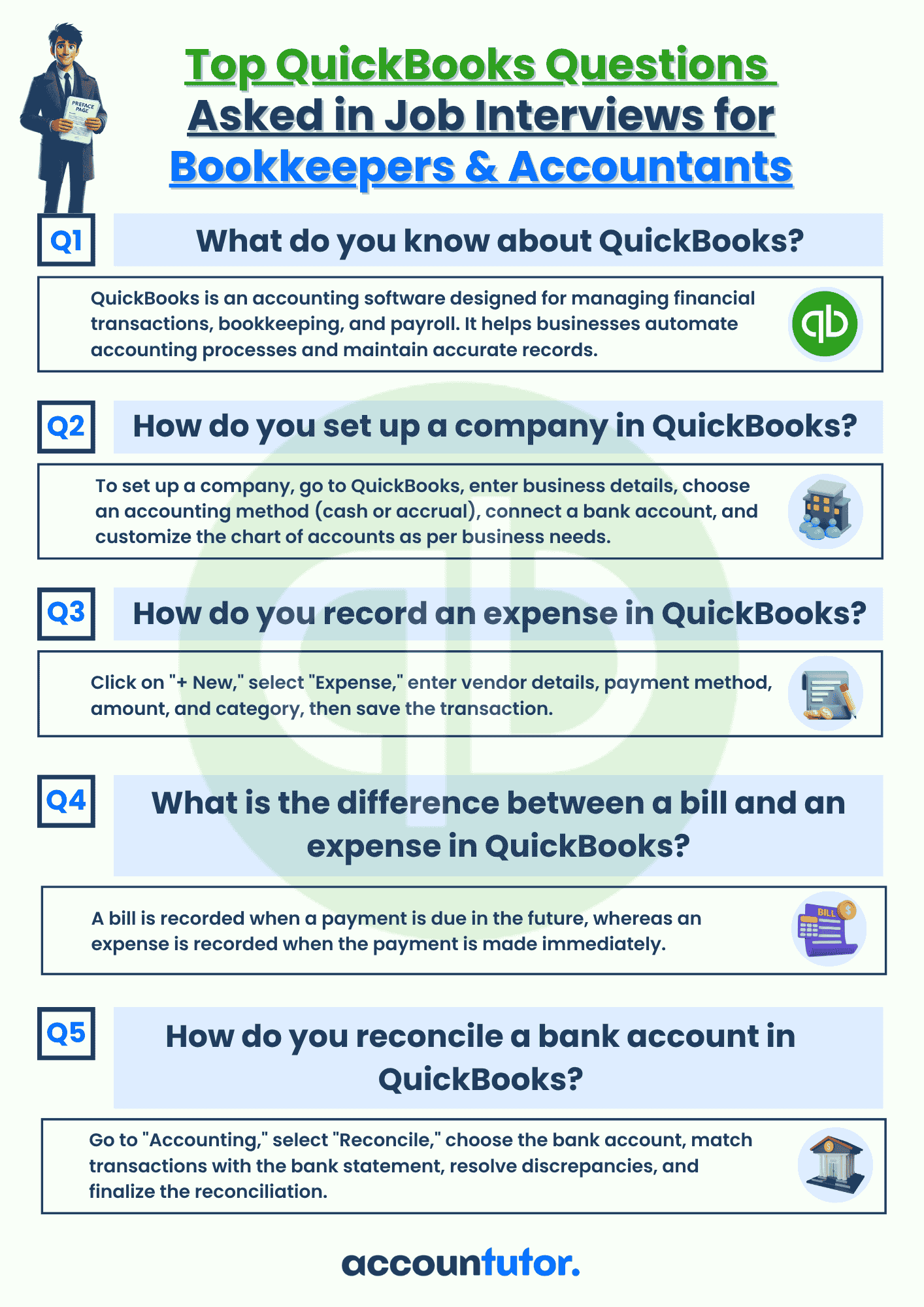

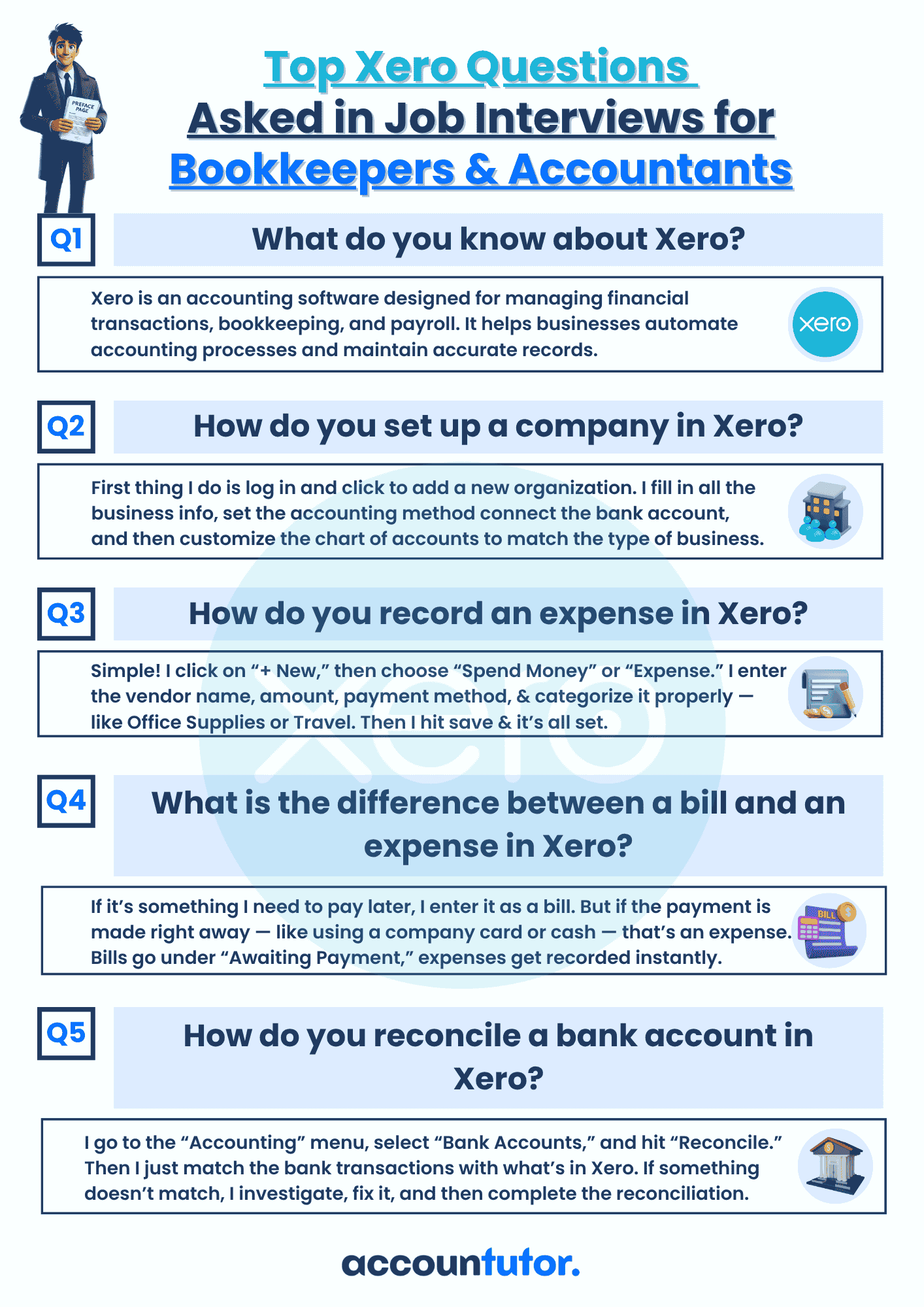

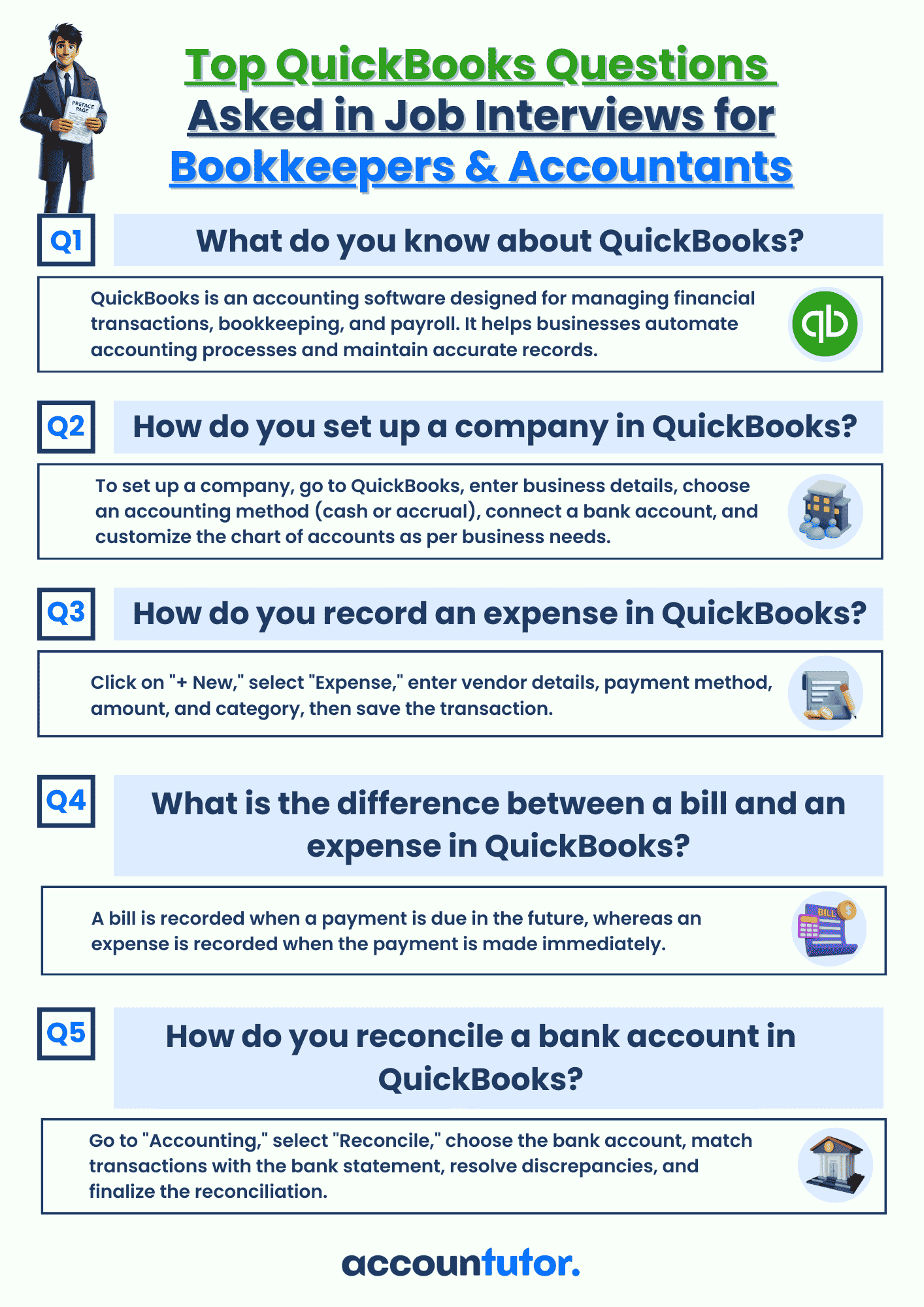

- Use Accounting Software: Tools like QuickBooks or Xero simplify bookkeeping and reduce errors.

- Regularly Review Financials: Frequent reviews help identify issues early.

- Seek Professional Guidance: For complex accounting needs, consult a professional accountant.

Take Your Accounting Skills to the Next Level

Ready to learn more? Enroll in our free mini-course, ‘Accounting Explained,’ on Accountutor.com.

Our courses are designed to simplify accounting concepts, offering practical examples and hands-on learning. From journal entries to financial statements, we’ll help you build confidence and expertise in no time.

Visit Accountutor.com today and start your journey toward mastering accounting!

Conclusion

Accounting is the cornerstone of financial management, providing the

insights and tools needed to ensure business success. From recording transactions

to interpreting financial statements, accounting offers a roadmap to

profitability, compliance, and growth.

Whether you’re just starting or looking to deepen your knowledge, accounting

is a skill that pays dividends. Take the first step today with Accountutor’s

free courses and resources, and unlock the potential of accurate and

effective financial management.

Start now at Accountutor.com and transform the way you manage your finances!

Subscribe to our newsletter

Policy Pages

Register for this webinar: How to Master QuickBooks Online— Without Feeling Overwhelmed